can you work part time on disability ontario

While youre getting Canada Pension Plan CPP disability benefits you may be able to. How much you receive is largely based on what you have already contributed to the plan.

Long-term disability benefits and work - working parttime will reduce income benefits.

. Generally an employee should expect to come back to their previous job or one that is comparable. Employers may offer various benefits as part of your group benefits package including short-term and long-term disability benefits. The hours he worked per weekmonth.

Depending on how much is earned your LTD benefits could be reduced to zero. Scheduled educational commitments or a scheduling conflict with other employment part-time workers only. Insurance policies can appear to be complex and difficult to understand.

SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. The ODC clarified that employers do not owe a part-time worker full time benefits even if the reason for their part-time employment was an accommodation for a disability. The ODC concluded that the employees different treatment was based on a different level of work and not their disability and was therefore acceptable under the OHRC.

The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems. Joseph returned to work on a part time basis in January 2022. Payments will stop if you are engaged in what Social Security calls substantial gainful activity.

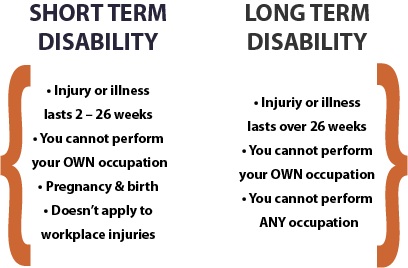

LTD benefits can top up where income earned is low. Earnings between 20 and 80 of your prior income will usually reduce your full LTD amount in proportion to your income. You dont qualify for benefits if you can work in a different job from the one you had before your disability based on your training experience and education.

If you are on ODSP and you want to work we can help with the costs of getting ready for inding and starting a job. An employer may offer short-term disability coverage in which case an employees earnings will be more secure in the event they are unable to work for a short-term period. As long as you.

You can earn up to 200 a month without having your income support reduced. Short-term disability is a type of insurance benefit that provides some compensation or income replacement for non-job-related injuries or illnesses that render you unable to work for a limited time period. For 2017 the income limit is 1170 per month.

ODSP and Work Can I work and still get ODSP income support. There is a wide variation in the types of policies available so the best way to find out is to read your policy documents carefully or. You must tell CPP if you go back to work full time or earn more than 10 of the years pensionable.

Joseph must call Service Canada to let them know he has earned 6400. In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial. Tell ODSP about any.

You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year. Or protected grounds under the Human Rights Code such as disability. Can I work and still get ODSP income support.

Additionally he needs to tell them. And you will always have more money while working than you would from ODSP income support alone. If you earn more than this amount called the substantial gainful activity SGA limit Social Security assumes you can do a substantial amount of work and you wont be eligible for disability.

He earned 6470 before taxes by June 2022. Many policies provide for residual or partial disability payments which allow someone capable of only part-time work to receive ongoing benefits. If you carry your own disability insurance whether youve bought your own policy or one has been provided to you through your employer working while on disability depends entirely on your policy.

Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. Employees required to work excess hours as a result of a would still have a right to refuse if the employee has unavoidable and significant family-related commitments. If you are receiving Supplemental Security Income SSI your income must be below that years Federal Benefit Rate.

The CPP disability benefit is a monthly payment for individuals who are unable to work regularly because of a disability. Instead you are able to work part-time or with modified tasks. Take a re-training program arranged by CPP.

Go back to school. Despite most disability claimants inability to work the actual standard is whether you can or cannot enough in meaningful work or substantial gainful activity The problem faced by many working claimants is that reporting any job even part-time one to the SSA may result in a denial of your claim. Similarly insurance companies may argue that you do not have a claim or that you are partially or residually disabled meaning you do not have access to long term disability benefits as you do not suffer a total disability which prevents you from working.

In New Jersey its considered fraud if you work and collect Temporary Disability Insurance. Working part-time while on CPP disability. Well update this information as things change.

You can work if you are receiving financial help from ODSP. When you fall ill or sustain an injury that leaves you unable to work for a period of time applying for disability benefits can seem overwhelming and like a monumental task. For example in California you can work part-time and still receive partial benefits as long as youre suffering a loss of income and meet the other eligibility guidelines.

In some cases if your earnings are too high you may no longer qualify for ODSP. You can work while you are getting inancial help from ODSP. The rules of the Ontario Disability Support Program ODSP say that you can work and still get.

Regular or own occupation The definition of regular or own occupation plan means youll receive benefits if youre unable to perform the main duties of the job you had at the time the disability started. Non-job-related is an important phrase to note there. You can earn a certain amount of money without losing your disability benefits.

That are between 9 and 16 months in the future. The date he returned to work. Working While on Disability.

If earnings are 60 to 70 of pre-disability income. Going back to work. If you work while receiving Social Security Disability Insurance SSDI you must make below a certain amount adjusted according to the years cost of living.

Deutschmann Law assists Personal Injury victims in the greater Kitchener Waterloo area. The taxable payment is available to individuals who have contributed to the Canada Pension Plan in the past. It is rare that an employer will be justified in ending employment.

How will my work affect my ODSP income support.

Famous People Who Use Wheelchairs Wheelchair Disability Awareness Wheelchair Users

Accounting Book Keeping And Payroll Services Toronto Ontario Accounting Services Tax Services Accounting

The Difference Between Short Long Term Disability Insurance

Cerebral Palsy Is The Most Common Physical Disability In Children Variety Offices Worldwide And Their Donors Assist Many Children Living With Cerebral Educacion

Can You Be Fired While On Short Term Disability In Ontario Monkhouse Law

Long Term Disability Ontario Know Your Rights Monkhouse Law

Oden Ontario Disability Employment Network

Short Term Disability Ontario Know Your Rights Monkhouse Law